Experiences

The one revolutionizing financial education

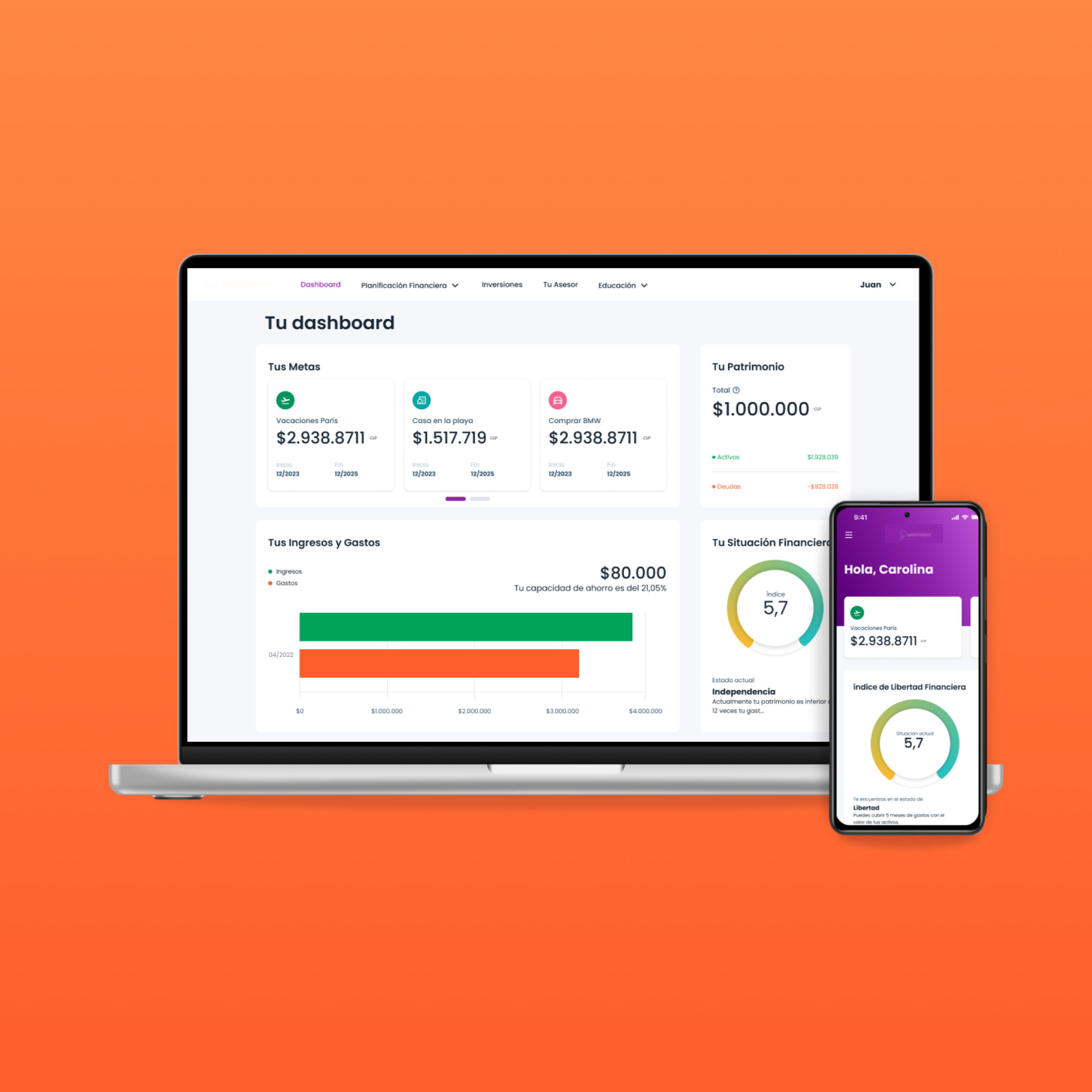

Web app

Discover how a leading FinTech partnered with Unagi to revolutionize financial education. We built a cutting-edge web app built using Ruby on Rails and Stimulus.js. The FinTech client faced the challenge of protecting proprietary business logic while enhancing the user experience (UX). They shifted from complex Excel spreadsheets to a streamlined digital solution. Unagi’s expertise enabled a swift transition, ensuring business continuity and paving the way for a secure, user-centric experience.

The problem

A leading FinTech client aimed to democratize financial education but faced two challenges. They needed to protect their proprietary business logic and improve the user experience (UX). They relied on complex Excel spreadsheets for financial planning. This was burdensome for users and risked exposing business logic to financial advisors.

The Solution

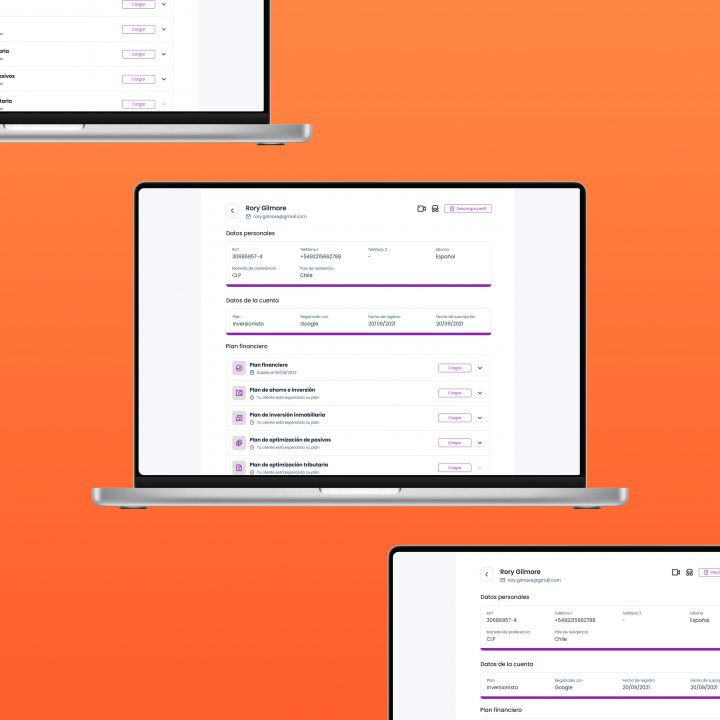

We began by understanding the client’s needs and business requirements. We safeguarded their business logic, which contained nine years of knowledge.

In less than 3 weeks, we created a Minimum Viable Product (MVP) using Google scripts. We securely migrated the business logic from Excel. Existing clients experienced uninterrupted service, ensuring business continuity.

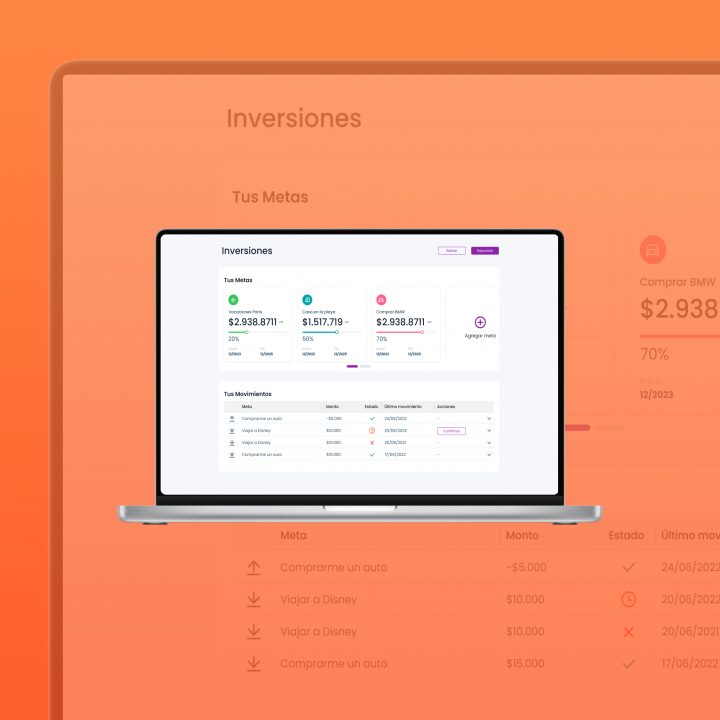

With the business logic transitioned, we crafted a state-of-the-art application. We used technologies like Ruby on Rails, Stimulus.js, PostgreSQL, and Rspec. This stack was crucial to build things quickly and allow them to scale. This new app simplified data input and streamlined workflows, offering a rejuvenated UX.

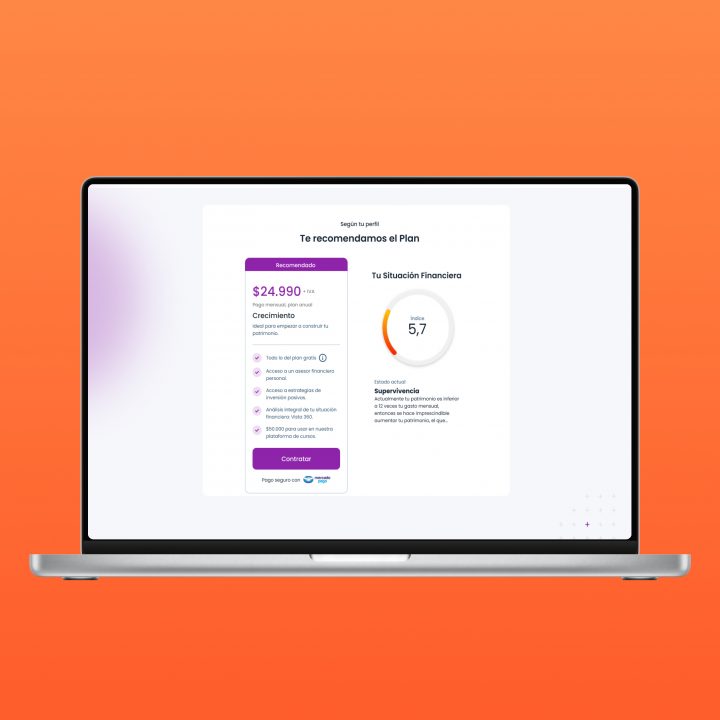

We also enabled direct financial investments from the app. This involved synchronization with external APIs, including brokerage firms and video conference apps. We integrated payment gateways like MercadoPago and Stripe, providing users with multiple payment options.

The outcome

By digitizing its operations, our client can now offer a more streamlined and secure financial education service. The improved UX has significantly enhanced user engagement. This contributes to the company’s mission of democratizing access to financial education. The investment module also played a crucial role in securing new financing rounds for the client.